A Safer Naper

July - Preventing Vehicle Burglaries and Theft

Burglary to motor vehicles is one of the most commonly occurring crimes in Naperville. It’s the unlawful entry into a vehicle to commit a theft. In many cases, burglary to motor vehicle is a crime of opportunity and occurs when thieves have easy access to your vehicle and the valuables left inside.

Last year, 77% of motor vehicle burglaries were unlocked vehicles, emphasizing that criminals will often move from car to car, pulling on door handles until they find one that’s unlocked to rummage through.

That makes locking your vehicle our number one prevention tip! Here are a few more tips:

DO …

... lock your doors.

... close windows and sunroofs.

... park in well-lit areas.

... take your valuables with you or, if you intend on leaving them in your vehicle, place them out of sight before you get to your destination.

... unload your valuables immediately when you return home.

DON’T …

... leave vehicles unattended with the doors unlocked or windows down.

... leave the keys in the vehicle, even in your garage or driveway.

... leave your purse, wallet, or cellphone in your vehicle.

... leave other valuables out in plain view.

... hide possessions under the seats; that’s the first place burglars check for stored items.

... cover items left on the seat or floorboard of your car; blankets and clothing present a clue to thieves that items may be hidden underneath.

... leave any important documents that contain your personal information in your car.

... hide a spare key on your car; thieves know where to look.

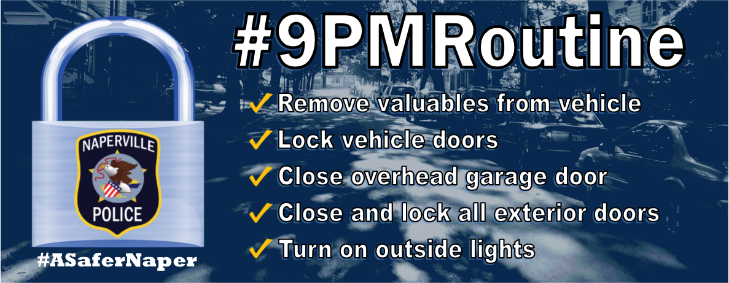

The 9 PM Routine

Need a reminder to get you in the habit of securing your vehicle? Follow the 9PM Routine!

The 9PM Routine encourages residents to get into a nightly routine of making your residence and vehicle(s) tougher targets for crime by taking proactive steps to combat thefts and break-ins. It helps you develop your own personal security routines by having a designated time to perform these tasks every night. Set a reminder for 9 p.m. to go through the following checklist to make sure your property is secure:

- Remove any valuables from vehicles left outside overnight. Remember, NEVER leave your keys or garage door opener in your vehicle.

- Lock vehicle doors.

- Close the overhead garage door.

- Close and lock all exterior residence doors and windows. Don’t forget to lock the service door from your garage to your house.

- Turn on exterior lights and leave them on until dawn.